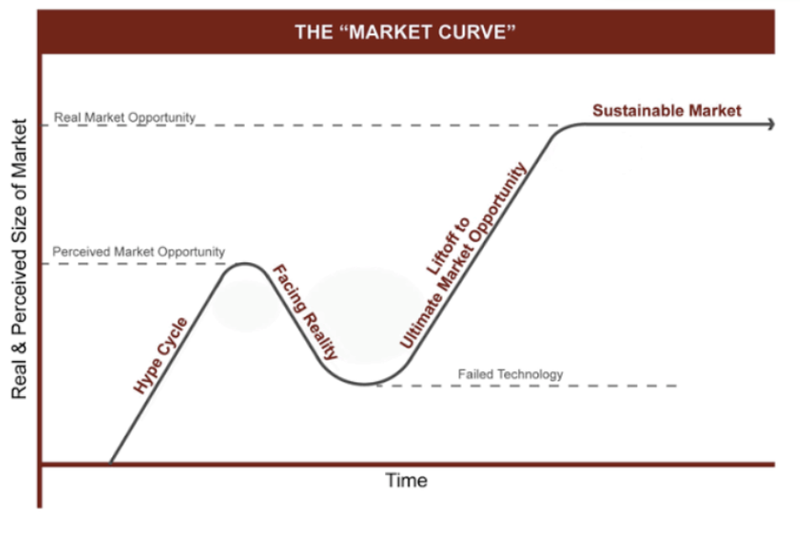

Why timing is so important when investing in tech

Published 29-JUL-2023 15:00 P.M.

|

11 minute read

Have you ever bought a small cap stock and it goes up nearly straight away... and stays up?

It doesn’t happen often.

Usually it takes a while for the company to deliver material progress that drives a sustained share price rise.

Often the stock will already have high expectations built into its share price, which the company needs to “grow into” over time.

And if these expectations aren’t met OR things take longer than everyone expects... the share price starts to languish.

This is primarily because impatient investors are moving on to other things.

Shinier things.

Key announcements taking longer than expected means more capital needs to be raised... probably at lower share prices.

Stale long term holders selling combined with lower and lower priced capital raisings leads to a period of a languishing share price we call the “capitulation phase”.

This capitulation phase can be compounded if the broader market stinks or during a bear market.

Assuming the company does EVENTUALLY deliver and comes out of the capitulation phase, if you are lucky enough to pick the turning point, it can be a great time to come in as a new investor.

When expectations (and the share price) are at their lowest...

It’s NOT a great time for long suffering existing shareholders - who have likely been holding for a few years (or more).

Long time shareholders will have been waiting for the company plan to execute and probably participated in a couple of capital raises at higher prices along the way to buy the company more time.

It’s always nice to swoop in at the right time, after years of heavy lifting (financing) by other shareholders.

When making a new Investment in a “capitulation phase” stock, we often ask ourselves - “is this the right cap raise to Invest in, or should we wait for the next one, which might be at a lower price?”.

We certainly don’t always get it right, sometimes our timing is good, other times we end up waiting a lot longer than we had hoped for the companies plan to come together.

We also note that some stocks don’t ever come out of capitulation phase - the ASX is littered with failed small caps that never recover - it’s a high risk place to invest.

In small cap land you’ll often be faced with a new cap raise at a lower price after you have invested in the company.

This can be because it takes longer than expected to deliver the progress that the market is expecting or the company has a couple stumbles along the way.

It’s not the end of the world (if you believe in the company and management), unless you are bothered by month to month share price fluctuations.

This is totally normal and expected in small cap investing.

It is especially prevalent in tech, where share price re-rates are driven by companies signing material new revenue, which generally takes longer than everyone (including the company itself) anticipates.

Tech stocks globally are currently experiencing a sharp rebound after an 18 month “tech wreck”.

Sometimes we get our entry timing right. Sometimes we don’t.

Here is an example of each from our Portfolio:.

- With ONE we managed to enter at a good time, after existing long term shareholders had done all the financing for a couple of years but the share price was well below its IPO price, and just as ONE started to finally deliver momentum.

- With WHK, we have been invested for many years, and in this instance we are the long term holders, but we have hopes the company is about to turn around and start delivering those long awaited large contracts.

When we first Invested in Oneview Healthcare (ASX:ONE), we managed to time it pretty well.

ONE provides hospital patients a “virtual care and digital control centre” at their bedside. ONE’s products are cloud-hosted patient dashboards that help make hospitals more efficient and patients more engaged in their own care.

We came in around five years AFTER ONE’s IPO.

The ONE share price had run on post IPO expectations but was well below the IPO price five years later.

ONE had already delivered a lot of progress in the five years before we Invested, but the share price was punished because it took longer than what the IPO investors wanted.

This was fine with us.

It was at this “capitulation phase” when we first Invested in ONE back in 2021.

Now, ONE has entered into an exciting new phase with building momentum. It recently signed a deal with NYSE listed Baxter - the largest hospital bed supplier in the US, and last week it raised $20M to accelerate the partnership.

We are participating in (applying for) the current ONE SPP capital raise - here is our latest update on ONE.

On the other side of the coin, where we didn't achieve ideal timing when we Invested in Whitehawk (ASX:WHK).

WHK is a USA based cybersecurity technology company, providing cyber risk products, services and solutions to large US government departments, defence industry and large enterprises.

We Invested in the WHK pre-IPO, at the IPO in 2018 and have increased our net position multiple times over the last five years at higher prices compared to where it trades today.

WHK has made progress the entire time, but like for the original ONE IPO investors, significant delays to contracts that the market is expecting pushed WHK’s share price into “capitulation phase”.

Some long term holders have been selling after (understandably) losing patience.

Our Investment thesis for WHK has not changed and we back the WHK management to eventually deliver, and hopefully see a material re-rate off its current sub $10M market cap.

We are also participating in the current WHK rights issue capital raise - here is our latest update on WHK.

Small cap investing can be a game of patience, especially in tech.

It may appear that everything is quiet, but in the background the company is refining its product, testing the market, learning what works and ushering along contracts.

The question remains, when is the best time to enter?

We don’t know, nobody does - it is unpredictable and very difficult to ever get perfect.

But here is what we have learned and what works for us (but may not be appropriate for everyone, depending on risk profile, investment time frame and risk tolerance).

What we have learned Investing in Tech:

There are a number of key learnings that we have taken out of Investing in technology companies on the ASX over the years.

- Buy slowly - take a starter position and continue averaging down/up on the position as long as the underlying Investment thesis doesn't change, and company management is trustworthy.

- Give the company time to deliver good news - big deals take time to lock away... companies need to be given time to deliver them, usually longer than they expect.

- Re-evaluate an Investment Thesis only if the fundamentals change - forget about the company's share price and look at the fundamentals... if nothing has changed, we will hold on (as hard as it is being patient).

- Watch the cash balance - Pay attention to the company’s cash balance and evaluate if the company has enough runway to deliver on its key product goals. If things take longer than expected, we ask ourselves if we are willing to accept the dilution from further capital raisings.

Again, this strategy works for our risk profile and saintly patience levels, and it may not be suitable for everyone.

Early stage tech companies, particularly those that are pre-profit, will be reliant on the capital markets to raise funds to operate and build value.

Dilutive capital raises can materially affect the value of the company. It can take many years for investments to realise value and many don’t at all.

Everyone hates waiting, it’s easier said than done, but we have made this a core part of the way we Invest.

In resource exploration, for companies where share price catalysts are well defined (nobody can argue with a big drill hit), the strategy is easier to follow, but for companies where key catalysts can happen at arbitrary times, it can be difficult to stay patient.

The sector where following a “patient approach” can be the hardest is tech.

Especially when lithium stocks are mooning all around.

Big tech deals can take years to finalise BUT when they get done, they can be transformational for the companies.

Especially now that the broader tech sector is bouncing back globally.

For tech companies selling into slow moving bureaucracies like governments, public utilities, large enterprises and hospitals, the decision making process is slow.

This means small companies (like WHK and ONE) that sell to these businesses can take longer to secure revenue.

However, once the sale is made, slow moving decision making works in the company’s favour - as the slow moving, hard to win, big client becomes a “sticky” long term client.

In summary,

- With the global tech sector having a big bounceback after a very tough 18 months

- small cap tech expectations still broadly low

- both ONE and WHK reporting big sales pipelines in recent weeks

We will be following both closely hoping for some big contract announcements and hopefully corresponding share price rerates.

To learn more about expectations and share price reactions read: Why do shares prices go up?

What we wrote about this week 🧬 🦉 🏹

Tyranna flexes financing force in $31M funding feat.

$31M funding deal and a binding offtake with $6.9BN Sinomine Resource Group.

Our 2022 Catalyst Hunter Pick Of The Year TYX is gearing up to drill again in October. With its 2023 exploration program around the corner we published a new Investment Memo.

Big Oil enters the lithium game... Mandrake was there first

MAN has been rapidly acquiring land in the Paradox Basin, Utah, USA aiming to re-enter old oil wells and establish a lithium resource - aiming to replicate the success of Anson Resource which hit a peak market cap of ~$490M.

WHK 3 cent rights issue, we are participating.

WHK has grown revenue every year since we Invested, pulling in US$3.2M in revenue in calendar year 2022 - and yet the market hasn’t been kind. The key? Big sales contracts needed.

PUR aiming to be the 3rd lithium carbonate producer on ASX

Ambitious PUR now has the funding to drill and get a lithium pilot plant producing up to 100 tonnes per annum. PUR is drilling at depth to find excellent lithium brines like its neighbour in Argentina.

Quick Takes 🗣️

OJC grows winter sales revenue 31%

Date set for DXB clinical trial result

RAS finds high grade lithium in rock chips

GTR airborne geophysics program completed

MAN - early indications of a large scale lithium project in USA

EMH Secures $6M Strategic Investment from European Bank

LCL keeps hitting more gold at Kusi in the PNG

ONE: ~$20 million placement and SPP to advance products

BOD’s CBD product improves bioavailability by 311%

LYN raises $1.5M to fund drilling & advance land access

TG1 to earn into new critical minerals project

PUR kicks off more geophysics at its lithium project

LCL now has the biggest nickel target in PNG

WHK extends US client contract

Macro News - What we are reading 📰

Biotech

Biogen to Buy Reata for $7.3 Billion in Rare-Disease Deal (Bloomberg)

Lithium

Australia blocks acquisition of lithium mine by China-linked firm (Al Jazeera)

Gold

JPMorgan sees gold charging to records in 2024 ahead of recession (AFR)

Oil&Gas

The $2.1trn reason it’s time to worry about oil (AFR)

Commodities

The Little Known Metals Giant that Rules a Global Market (Bloomberg)

Miners, WA tell Albanese to butt out of Aboriginal heritage (AFR)

OPINION: Critical Raw Materials Act: Europe’s attempt to have both quality & speed (Benchmark Minerals)

⏲️ Upcoming potential share price catalysts

Updates this week:

- LCL: Drilling at its primary PNG copper-gold target.

- LCL put out news on its nickel project in PNG. LCL now holds the biggest nickel anomaly in the entire country. See our Quick Take on the news here.

- NHE: Scheduled to drill two targets at its helium project in Tanzania (Q3 2023).

- NHE put out a prospective resource upgrade for its first drilling target - Mbelele. The prospect now sits at ~15.7Bcf almost double what it was before this weeks announcement. See our Quick Take on the news here.

- TG1: Drilling at its NSW gold project in May.

- No drill results this week but TG1 did announce a new option/earn-in agreement for new battery metals projects. See our Quick Take on the news here.

- DXB: Interim Analysis of Phase III Clinical Trial on FSGS (Q4 2023).

- DXB set a date for the interim data from its FSGS trial. See our Quick Take on the news here.

- TMR: Maiden JORC resource estimate for its Canadian gold project.

- TMR announced a delay to its maiden JORC resource estimate. TMR now expects the resource to be announced in August/September. See our Quick Take on the news here.

No material news this week:

- GAL: Drilling at its Jimberlana & Mission Sill prospects at its PGE project in WA.

- IVZ: Drilling oil & gas target in Zimbabwe, Myuku-2 (Q3, 2023).

- KNI: Drilling 3/3 of its Norwegian battery metals projects in Europe.

- SLM: Maiden drill program at its Brazilian lithium project

- BOD: Phase III clinical trial for CBD insomnia treatment.

- LNR: >10,000m drill program at rare earth’s project in WA.

Have a great weekend,

Next Investors

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.